Home Renovation Loan Uk

Range of personal loans from £1,000 to £20,000, or £25,000 if you’re an existing santander customer a personal loan could bring your home improvement plans to life. from an extra bathroom, to a new kitchen, to a loft conversion, you could borrow the money you need to make the change you want. london, nw1 3an, united kingdom. Nationwide home improvement loans cash into your nationwide current account in just two hours from just 2. 9% apr representative (fixed) on unsecured loans from £7,500 £25,000 over 1 to 5 years for our members with a mortgage, savings or main current account. Nationwide home improvement loans cash into your nationwide current account in just two hours from just 2. 9% apr representative (fixed) on unsecured loans from £7,500 £25,000 over 1 to 5 years for our members with a mortgage, savings or main current account. Read bankrate's expert lightstream review. sofi: best lender for all home improvement loans. overview: sofi, an online-only lender, offers personal loans for home improvements ranging from $5,000.

Home Improvement Loan House Renovations Hsbc Uk

Your home is an investment, and home improvement loans can offer the funding you need to strengthen that investment with renovations, updates and repairs. however, there are risks involved, and not all home improvement loans are the same. this guide covers the types of home improvement loans available, the costs of a home improvement loan, how to qualify and how to choose the best lender. Home improvement loans can help add value to your property but you must get the cheapest deal to keep costs low. compare the best loans to help pay for your renovation here. choose the cheapest rate to get the best deal on your borrowing. Home improvement loans can help add value to your property but you must get the cheapest deal to keep costs low. compare the best loans to help pay for your renovation here. choose the cheapest rate to get the best deal on your borrowing. Bad credit ok. apply in 60 seconds. helps people to get approved for their bad credit loans! quick easy guaranteed cash advance online. same day short terms loans unsecured, no credit check and instant approval.

Home Improvement Loan House Renovations Hsbc Uk

Loans. if you’re interested in taking out a loan, cutting your existing loan costs or you just want to know more about your credit score and how to boost it, we have a range of guides to help inform your decision. A home improvement loan allows you to borrow a set amount in order to fund home renovations or other projects to your property. these home renovation loan uk typically come in the form of an unsecured personal loan, but you can also secure the loan against your home, which normally allows you to borrow larger amounts. One of the best-known loans for home improvements, fannie mae’s homestyle renovation loan, allows borrowers to either buy a place that needs repairs or refinance their existing home loan to pay for.

If you have sufficient equity in your current home to fund the renovation, including the purchase, you could use a bridging loan (the other option is to re-mortgage): this type of loan is easier to arrange than a mortgage or advance, especially for those with a modest income. A home improvement loan can be used as an upfront payment for work you want to do to improve your home and hopefully increase its value. you might install a new kitchen or bathroom, or build an extension or loft conversion. you then pay back the money you borrowed over a set period of time (the loan term). Taking out a personal loan of £60,000 to £100,000 can help you secure the funds you need to complete home renovations, start a business or consolidate existing debts into a more easily managed repayment. consolidate their debts and potentially help with necessary renovations around the home however, have you really thought your home must have good equity

Home improvement loans nationwide.

A home improvement loan is an unsecured personal loan you can use to fund the costs of home repairs, renovations or additions. you can get a personal loan from a bank, online lender or credit union. Compare home improvement loans. comparing home improvement loans can help you find the best loan for you. our loans search tool asks you a few questions on how much you’d like to borrow for your home improvement loan and how long you’d like to be paying the loan back.

Loan Guides Moneysavingexpert

Spread your repayments over 1 to 5 years for loans of £15,000 or less, or up to 8 years for loans over £15,000. 3. 3% apr* representative for loans between £7,000 and £15,000. Santander uk plc. registered office: 2 triton square, regent's place, london, nw1 3an, united kingdom. registered number 2294747. registered in england and wales. www. santander. co. uk. telephone 0800 389 7000. calls may be recorded or monitored. Home improvementloan features and benefits with a lloyds bank personal loan, you could receive a rate of 3. 9% apr representative apr stands for the annual percentage rate of charge. you can use it to compare different credit and loan offers. Finance for renovations, including non-habitable properties and conversions, covering borrowing limits, how to find a deposit, funding an extension, borrowing tips and different borrowing options, including re-mortgaging, home improvement loans, bridging loan, personal loan, extended overdraft facility, credit cards, renovation, conversion and accelerator mortgages, peer-to-peer lending.

A home-improvement loan may not be the best option for older borrowers because this will cause them to be in debt in retirement. with equity release, you will never owe more than home renovation loan uk the value of your. U. s. news conducted an in-depth review of the leading u. s. mortgage, home equity and home improvement lenders. lenders were evaluated based on product availability, customer service ratings (using j. d. power’s 2018 u. s. primary mortgage origination satisfaction study), qualification requirements and loan terms. There’s always something that needs doing around the house. whether you’re planning a new bathroom or kitchen, or thinking about converting the loft, a home improvements loan could help you get the most out of your property sooner rather than later.

The most popular way to finance a large home improvement project is with a home equity loan or line of credit or with an fha 203(k) loan. the most popular way to finance smaller projects is with. A home renovation loan gives homeowners access to funds needed to fix up their home. these renovation loans can come in the form of mortgages with built-in fixer-upper funding or personal loans. depending on the type of loan you receive, you may need to show proof that the money was spent on the house or paid to a home renovation loan uk contractor.

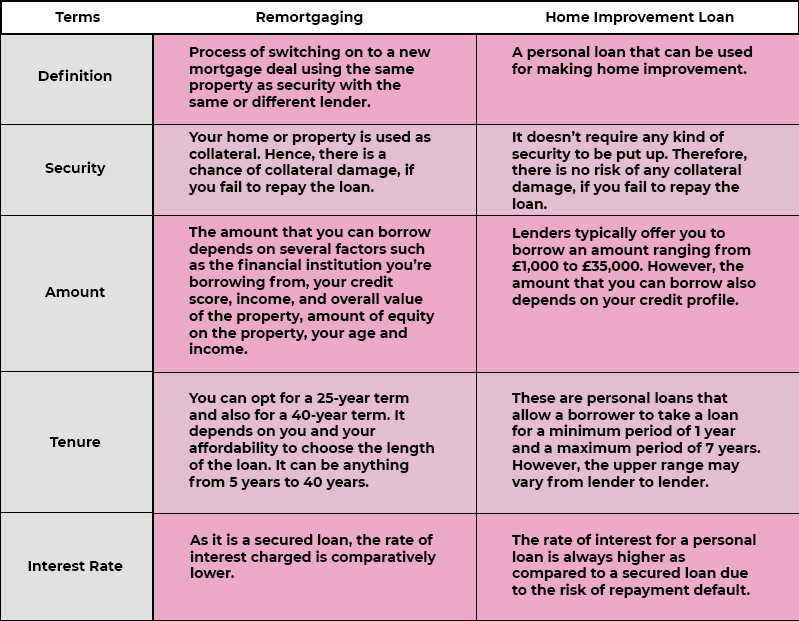

offer cash assistance when you need it for renovations, new business, educational costs and more the missouri usda rural development loans process is extremely challenging and you need experts to guide you each step of the way and to ensure that you are making the correct financial decisions click this for more accessible visit wwwpaydayloanscale our specialists will home renovation loan uk make certain you can make the best choices with regards to home loans you could find plenty of st louis Another way to finance your home renovation is by taking out a home equity loan, also known as a second mortgage. this is a one-time, lump-sum loan, so it’s not subject to fluctuating interest. Remortgaging. you could consider remortgaging your home. a remortgage is the process of transferring your mortgage from one lender to another. for example, if you have £150,000 outstanding on your existing mortgage and you’d like £20,000 for home improvements, you may be able to find a mortgage lender willing to lend you £170,000.

Komentar

Posting Komentar